Balance of payments: From deficit to surplus

VGP - Balance of payments shifted from deficit in 2009 and 2010 to surplus in 2011 and the trend continued the first half of 2012, according to the State Bank of Viet Nam (SBV).

|

|

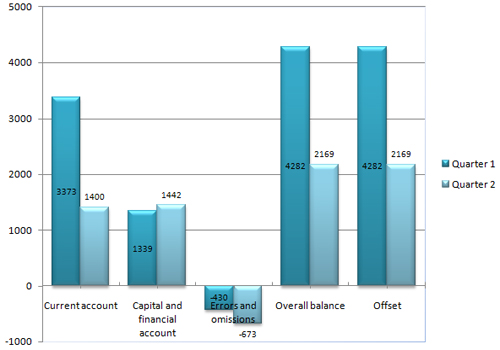

Payment balance (million USD) in Quarter 1 and Quarter 2 of 2012 – Source: The State Bank of Viet Nam |

The improvement can be attributed to a number of reasons, including the Government’s top priority to rein in inflation, stabilize macro-economy, ensure social welfare, restructure the economy and transform growth model.

Noticeably, the Government had been sticking to control inflation and stabilize macro-economy even when the consumer price index dipped for two consecutive months.

Moreover, the ratio of investment to GDP declined sharply from 42.7% in the 2006-2010 period to only 34.6% in 2012 and projected to down to 33.5% in 2012.

Also, budget overspending fell from 6.7% in 2008 to 4.9% in 2011 and about 4.8% in 2012 and the current account gained surplus of US$4.774 billion in the first half of 2012.

Besides, trade balance posted a surplus of US$2.191 billion in Q1/2012; US$1.930 billion in Q2/2012 after suffering a deficit of US$ 2 billion in the same period last year.

The balance of payments surplus pushed foreign reserve to increase by nearly US$6.5 billion in the first six months. The surplus is forecast to continue to the end of this year thanks to recovering current account, excess of exports over imports, and stable remittances./.

By Khanh Phuong