Corporate tax payment continues to be delayed

VGP – The Vietnamese Government has decided to stop tax exemption and reduction policies and, instead, delay the payment of corporate revenue tax for small and medium enterprises in the first quarter next year.

|

|

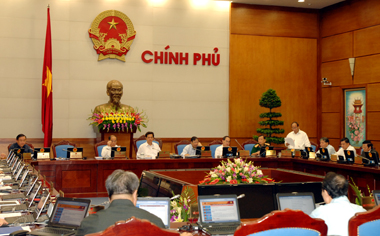

The Cabinet’s members at the Government’s October regular meeting which takes place on October 29-30, 2009 in Hà Nội – Photo: VGP |

The decision came in the wake that the national economy is steadily getting back on track.

The Government assigned Ministries, sectors and localities to continue deploying economic stimulus solutions and ensure sufficient capital for projects, especially those on infrastructure, transport, irrigation, social housing, and poverty reduction.

Measures and policies on social security will also be further enforced, says the Government’s resolution.

The State Bank of Việt Nam (SBV) was asked to consider the proper realization of interest rate incentives.

Thus, financial assistance given to individuals and organizations to promote production and farmers to buy inputs for agricultural activities will be adjusted in the time to come.

|

Some positive achievements brought back by the Government’s stimulus packages: Industrial growth rate, falling by -4.4% in January, rebounded steadily and went up 11.9% in October, compared to the same period last year. Until August 31, over 125,500 turns of enterprises and around 937,000 individuals enjoyed tax preferences, of which more than 36,000 enterprises got a 30% reduction for corporate revenue tax, 42,000 others enjoyed tax delay, and another 47,000 got 50% VAT discount Poverty reduction rate is expected to stand at about 11% by the end of this year, exceeding the pre-set target. |

By Hải Minh