E&Y upbeats about VN’s economic prospect

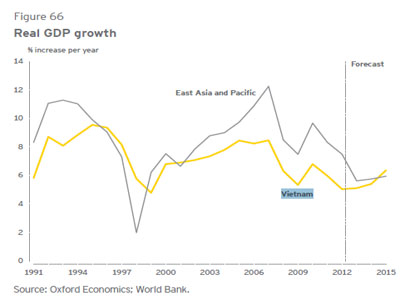

VGP – There is an optimistic prospect for the Vietnamese economy in the coming time. With growth held down to about 5% in 2012 and 2013, policy makers will target faster expansion from 2014.

|

According to the Rapid-Growth Markets Forecast of the Ernst & Young (E&Y), Viet Nam ranked 4th among 25 countries which have fastest growth rates and are vulnerable to seven risks namely current account, external debt, government debt, inflation, growth in credit to GDP, import cover, and currency change over year.

Viet Nam’s GDP would touch 5.4% in 2014, the forecast said.

The growth rate is set to pick up to the 7% target by 2016 thanks to the Government’s effort to reduce the fiscal deficit and use lower inflation to bring down borrowing costs.

The multinational professional services firm reported that CPI inflation would stand at 6.5%; current account balance (% of GDP) 1.6%; exchange per US$ (year average) 21,508 in 2014 and 22,000 in 2015.

E&Y said that a strong rebound in FDI commitments will underpin the financing of the external deficit that is expected to reappear from 2015.

This will calm concerns about the stability of the Vietnamese Dong (VND) that have resulted from low reserves.

FDI will promote a shift away from textiles and agriculture, the decline of which lie behind the widening trade gap in Q4, 2013.

With capital inflows stabilizing the VND, inflation will continue to subside, ensuring a return to real wage growth in 2014-17./.

By Kim Loan